We Are Hartford. We Are the Alliance.

People and businesses thrive in our state’s vibrant capital region. The MetroHartford Alliance tells the Hartford story globally as an exceptional place to build a business, industry, career, and future.

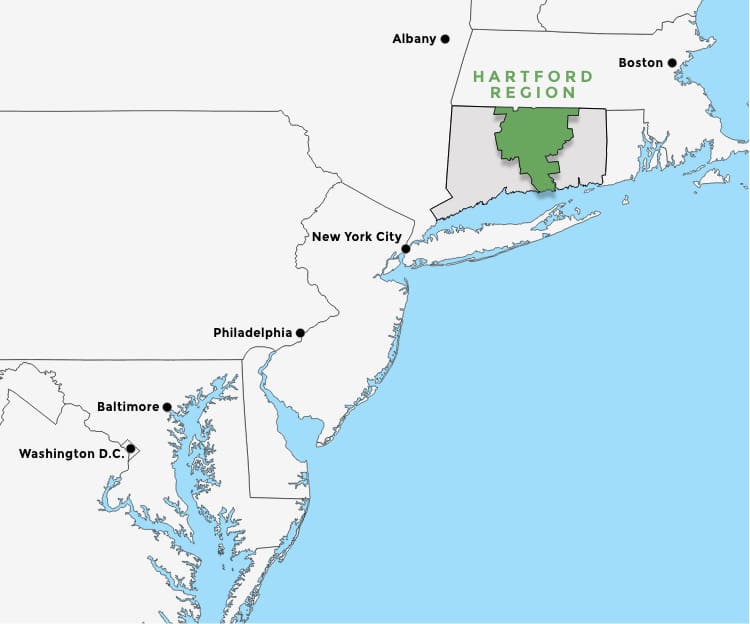

In the Heart of the Northeast

Hartford boasts an impressive transportation network of air, rail, and highways that connect you to the entire Northeast and beyond.

Close to Major Markets

The Hartford Region has easy access to major markets such as New York City, Boston, Philadelphia, Baltimore, and Washington D.C.

Globally Connected

Global businesses choose Hartford due to its talent, concentration of corporations, and connectivity from having a top 5 airport the nation.

Alliance Initiatives

The MetroHartford Alliance strategic goals encompass multiple initiatives that focus on recruiting businesses to the Hartford Region, developing a dynamic urban core, attracting and retaining talent, and more.